An Insurer Becomes Insolvent Which of the Following

Medicaid is intended for. 1990 forty-three nationwide insurers were declared insolvent by state regulators2 The fifty states as regulators of the nations insurance companies have found themselves with a burgeoning nightmare.

A when averaged over the period of 4 years prior to the date on which the member insurer becomes an impaired or insolvent insurer under this part exceeds the rate of interest determined by subtracting 2 percentage points from Moodys corporate bond yield average that is averaged for that same period or for a lesser period if the policy or.

. When tornadoes damaged a large number of structures in the city the insurer did not have adequate financial resources to pay the losses and it became insolvent. Inadequate pricing and loss reserves II. Every Pennsylvania insurer upon receiving notification of a claim must acknowledge receipt of the notice within.

Only beneficiaries of insurance firms permitted to offer insurance products in that state are covered by the fund. The California Life Health Insurance Guarantee Association is an association of all insurance companies licensed to sell life insurance health insurance and annuities in California. But the insolvency is the latest blow for the Florida.

Fly-By-Night Insurance Company had much larger losses than forecast. The firm will then often enter the insolvency process eg administration provisional liquidation or liquidation and a court appoints an IP to manage the firms affairs. The policy will terminate if the loan plus interest equals or.

The claim was directed to the MIB which settled the claim following service of court proceedings and did not take the insolvency point. ISO Commercial Liability Umbrella CU 00 01 04 13 states the following. Rapid growth and inadequate surplus.

Created by state law it provides limited protection to policyholders when an insurance company licensed in California to sell life insurance health insurance and annuities becomes insolvent. A small property and liability insurance company concentrated its underwriting efforts in one city in Oklahoma. These standards are based on a model law drafted by the National Association of Insurance Commissioners NAIC.

The company did not charge adequate premiums nor did the company purchase reinsurance. To book Caroline please contact Francine Kirk or Talia Webster on 0113 245 9763. The insured or insureds underlying insurer has become obligated to pay the retained limit.

In setting up a state guaranty fund there is need to deal with level of coverage pre-insolvency versus post-insolvency assessments and the potential advantages of risk-based assessments. Avatar launched in 2008 is a smaller insurer in Florida with about 42000 homeowner policies about a quarter the size of St. An insurance insolvency occurs when an insurer finds itself in financial difficulty and the regulator believes it wont be able to meet its liabilities.

If an insurance company is declared insolvent the state guaranty association and guaranty fund swing into action. A guaranty fund B premium rebates C risk-based capital D admitted assets. The maximum coverage limit for health care for the following insolvencies is as follows.

Even if some customers do default on their loans there is a. The company did not. This decision provides welcome clarification about the scope of the Fourth Motor Insurers Directive.

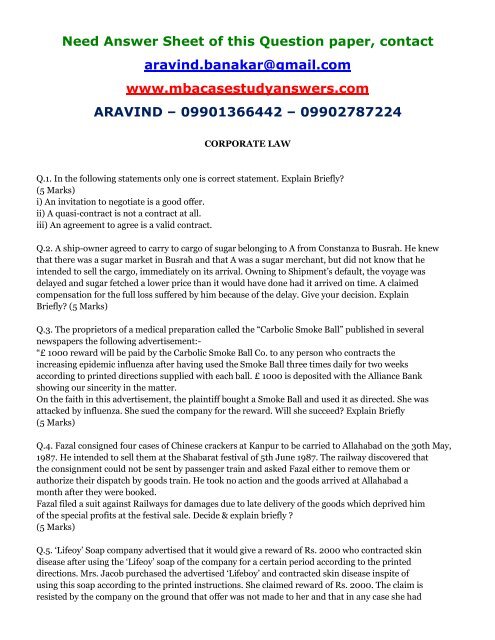

The following example shows how a bank could become insolvent due to a bank run if it did not have access to lender of last resort funds. These standards are called. If Fly -By-Night becomes insolvent which of the following will help pay the unpaid claims of the insurer.

Violating Pennsylvania insurance law may result in which of the following Insurance Department actions. Guaranty fund premium rebates risk-based capital. Initially the bank is in a financially healthy position as shown by its balance sheet its assets are worth more than its liabilities.

Generally when an insurance company is placed in liquidation agency contracts are terminated unless the liquidator extends or renews the agency contract and any property belonging to the insurer in the hands of an agent at the time of liquidation now belongs to the liquidator and must be turned over to the liquidator upon demand. If an insurer becomes insolvent which of the following would pay benefits to policyholders. The maximum limit for health care benefits is increased or decreased based upon changes in the healthcare cost component of the consumer price index from January 1 1991 to the date on which the insurer became insolvent.

If Fly-By-Night becomes insolvent which of the following will help pay the unpaid claims of the insurer. Provide policy owner protection if an insurer becomes insolvent. Liability under this Coverage Part does not apply to a given claim unless and until.

The company did not charge adequate premiums nor did the company purchase reinsurance. The major reasons for insurer insolvency include which of the following. The association will transfer the insurers policies to another insurance company.

All of the following are true regarding insurance policy loans EXCEPT a. For example the Insurance Services Office Inc. Fly-By-Night Insurance Company had much larger losses than forecast.

To reduce the risk of insolvency life and health insurance companies must meet certain capital standards based on the riskiness of their operations and types of investments. Policy loan can be made on policies that do not accumulate cash value. Due to a combination of factors ranging from the real estate slump to.

Life Insurance Companies Becoming Insolvent 2022 Protect Your Wealth

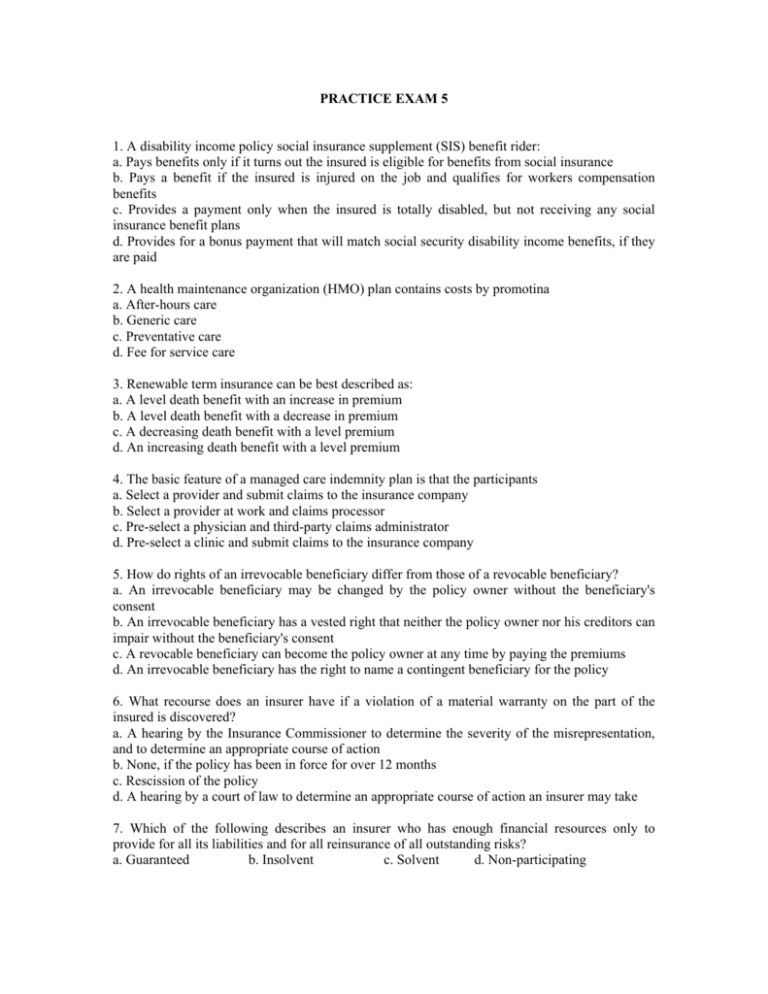

Practice Exam 5 1 A Disability Income Policy Social Insurance

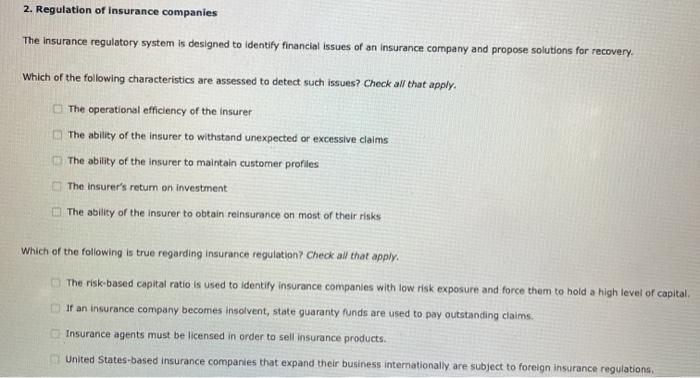

Solved 2 Regulation Of Insurance Companies The Insurance Chegg Com

Solved 1 Which Of The Following Is A True Statement Chegg Com

Life Insurance Companies Becoming Insolvent 2022 Protect Your Wealth

Practice Exam 5 1 A Disability Income Policy Social Insurance

![]()

Life Insurance Companies Becoming Insolvent 2022 Protect Your Wealth

![]()

Life Insurance Companies Becoming Insolvent 2022 Protect Your Wealth

A An Unpaid Seller Sends Goods To B By Railway B Becomes Insolvent And A Sends

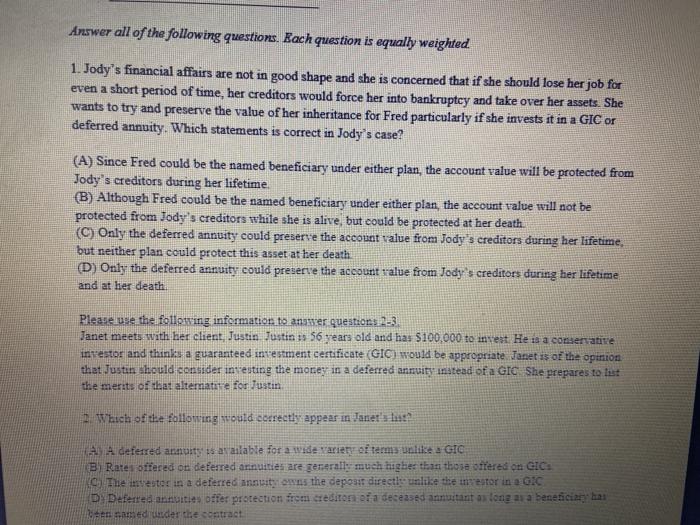

Answer All Of The Following Questions Each Question Chegg Com

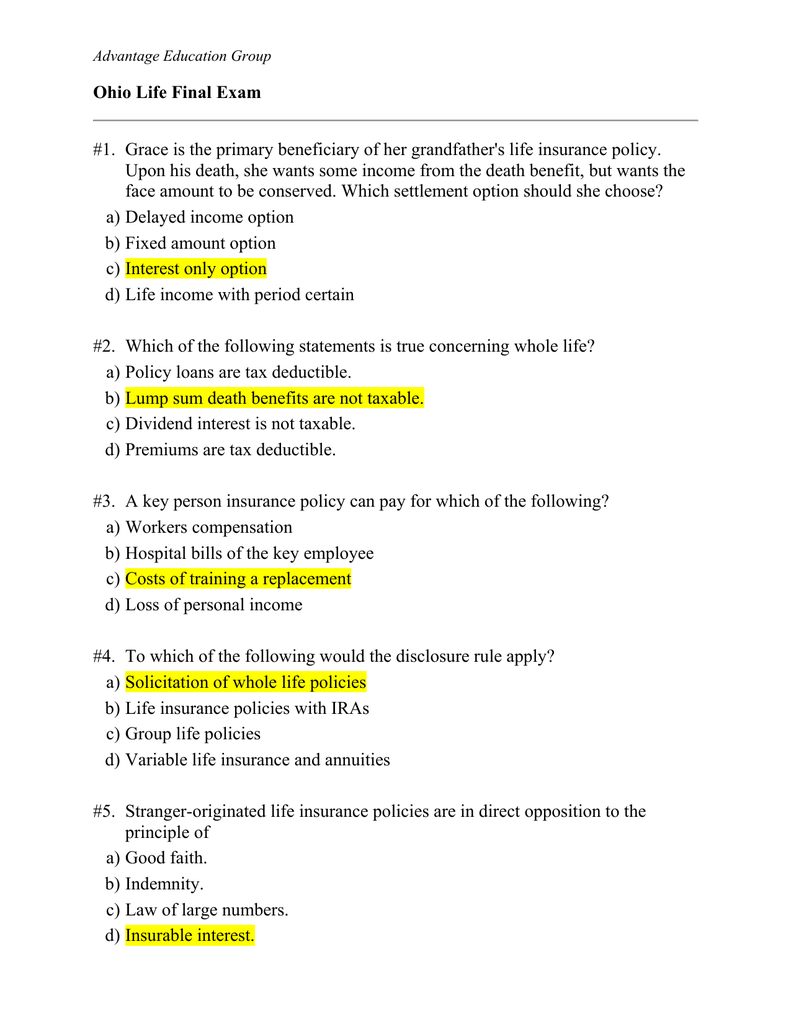

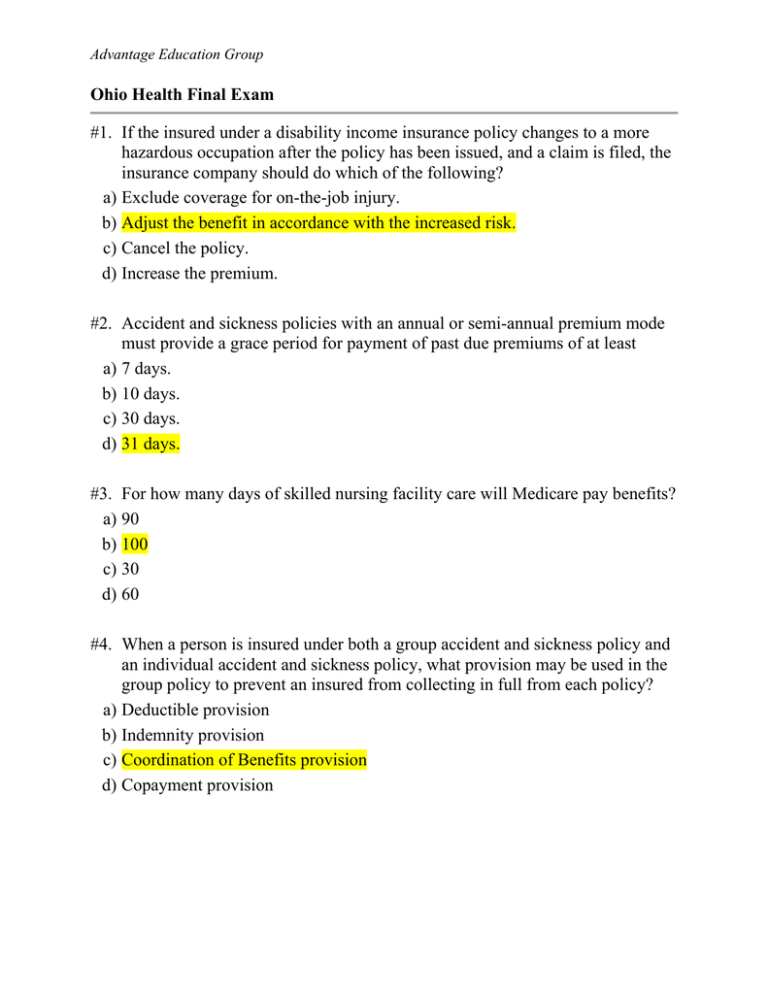

Advantage Education Group Ohio Life Final Exam Pdf Free Download

Comments

Post a Comment